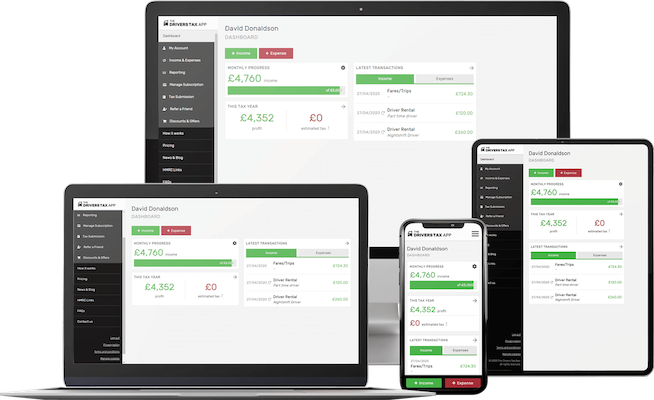

Your tax return, done-for-you! Enter your income and expenses then hit “produce” and your tax return is DONE! Download FREE Tax Saving Guide

New legislation requires those self-employed and working within the “Hidden Economy” to undergo a Local Authority “Tax Check” with HMRC at licence renewal.

If you have not registered as self-employed with HMRC - your licence will not be renewed!

Get registered now - click this link to learn how.

If you are a taxi, private hire, courier, delivery driver, chauffeur, or driving instructor, doing your accounts and tax returns are now a whole lot simpler. And will save you a small fortune.

Using The Tax App, you just enter your income and expenses then hit “produce”, and your tax return is DONE!

Hit “submit” to send it to HMRC, who immediately email you a confirmation.

Really. It is that simple!

You will also be ready for Making Tax Digital.

Making Tax Digital is the name given to HMRC’s new tax rules.

These rules require drivers to submit four tax returns a year plus a crystallisation statement at the year-end.

Current accountant fees average £350 for one return and will be significantly higher for four! We also know (especially during the current pandemic) that drivers cannot afford these fees.

This new affordable and efficient solution calculates and completes your tax return for you and submits it to HMRC; saving you time and money, allowing you to focus on work and forget about accounts.

HMRC checked the software before it could become “HMRC Recognised”.

You can now subscribe to the App by choosing either a monthly or annual pricing plan.

Your bookkeeping, accounts and tax return will never get any easier, than with this Web-App!

Remember, you just enter income, enter expenses, then hit “produce” and your tax return is done.

You hit “submit” and it goes to HMRC, DONE!

What could be simpler?

Sign up